By the time you’re ready to buy a house, you’ve already done the hard work of saving up for a down payment. You probably also have a general idea of what you want in a home and the area where you plan to look. Beyond that, most first-time homebuyers don’t really know what to expect from the process, or even how to get started.

Sign up for our Blog!

Before you take the first real step forward, it’s a good idea to learn as much as you can. To help you get started, let’s take a closer look at some of these considerations.

Steps to a Great Home Buying Experience!

1.Understand Your Finances First

Many first-time homebuyers make the mistake of starting their home search before getting their financing lined up. We know how exciting it is to think about finding your new home, but jumping ahead can lead to frustrating situations. You may realize you’ve been looking at homes that are out of your price range, or you may find “the one” without being prepared to make an offer.

Check Your Credit: Checking your credit score is a crucial first step because it can affect what kind of interest rate you can get and may even determine the type of loan you’re approved for. Getting a credit report first also gives you the chance to correct any mistakes.

Shop for a Home Loan: Many first-time buyers don’t realize that there are multiple types of home loans, as well as different types of lenders. According to the Consumer Financial Protection Bureau, most people get conventional home loans, but there are also FHA and other special loans, such as VA loans for veterans and their families. You’ll also want to decide where to shop for your loan, whether through a direct lender like a local bank or through a mortgage broker or real estate company.

Once you’ve found a lender, the next step is to get a pre-approval for a mortgage. One of the most important things to keep in mind is that pre-approval tells you the maximum amount of a loan you can qualify for, but that doesn’t mean you should necessarily spend the max. As Nerd Wallet explains, you want to be sure your mortgage payment is an amount you can comfortably afford.

2.Start Searching for Your Dream Home

With your home-buying budget in mind, the next step is to find an experienced real estate agent and start looking at homes. Touring homes is exciting, but first-time homebuyers should also be prepared to think critically and not get caught up in emotions. Your real estate agent’s job is to guide you through this step, and they’ll be able to help you put together an offer, and they know how to handle special situations.

3.Make an Offer and Close on Your Home

When you’re ready to make an offer, it’s important to stay conscientious about your budget and ensure you don’t skip any crucial steps. For example, the amount you offer for a home is only part of the equation. Make sure you also consider maintenance costs, along with other necessities like a home warranty. Getting a home warranty is a smart way to get peace of mind that unexpected issues won’t bust your budget.

4. Consider a Home Warranty

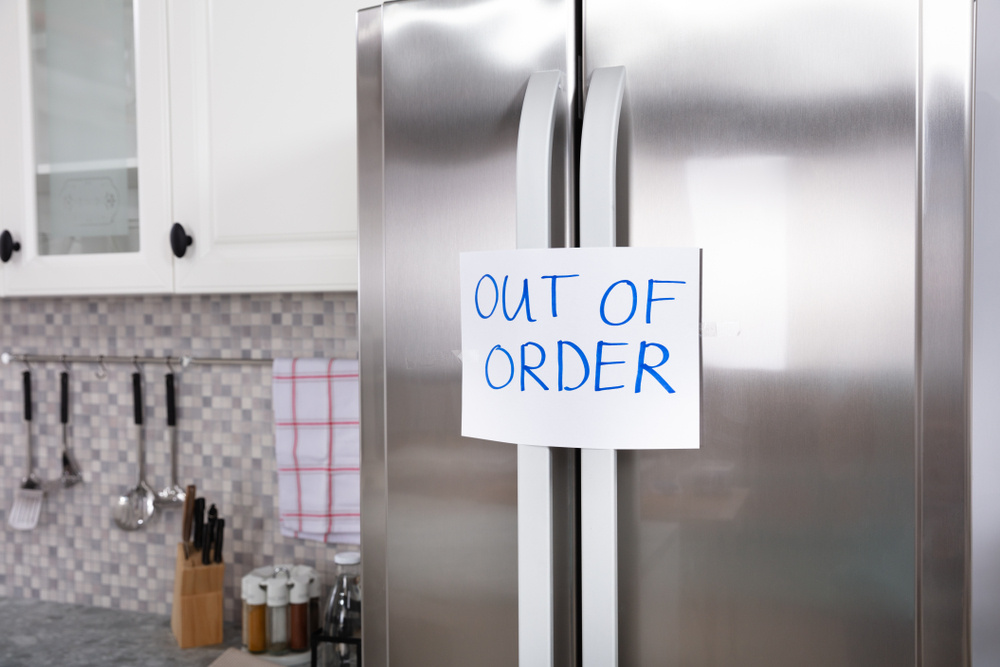

Lastly, consider how you will protect your home and the products in it. For new or existing home purchases, the appliances and systems in your home, like the HVAC, plumbing, electrical, and even utility lines and pools and spas (if you're lucky enough to have them!) will need maintenance and repair at some point during home ownership. The average price to fix an appliance, like a refrigerator is almost $300.

For new home buyers, especially the Millennial or GenZ, or even Generation Xers and boomers without a lot of disposable income, putting aside enough funds to pay for maintenance and repairs can be challenging. Home warranties are a great solution to protect your home products and systems, paying for repair costs for covered breakdowns. Home warranties are not insurance, however, they pay for damages. Home warranties cover mechanical breakdowns of covered products. They typically cover your home products and systems for 1- 5 years, and can be purchased all at once as an annual plan, or as a monthly or quarterly subscription. However, not all home warranties are created equally. Look for a home warranty provider that's insured by a top-rated insurance company, so that they're around when you need them. Make sure the home warranty company is run by people that understand how to provide product service and that use technology and an expert service network to make your life as easy as possible! You will also find that most realtors have options they can offer for home warranties at your home closing.

You can check out options for home warranties by clicking the button below!

Buying a home is probably the biggest investment you’ll ever make, so you want to do everything you can to protect it. It’s true that house hunting is a multi-step process, and it doesn’t usually happen fast. That doesn’t mean it has to be intimidating, though! Doing some research and working with qualified professionals will help clear the confusion, and you’ll get to closing with confidence and the joy of success. And, by evaluating home warranty options, at the closing or shortly thereafter, you'll ensure that your products and home systems are protected, giving you peace of mind and confidence over the long term.

Learn more about fixHomz's home warranty plans, extended warranty plans for electronics, and on-demand home services from fixHomz

.jpg)

.jpg)

.jpg)